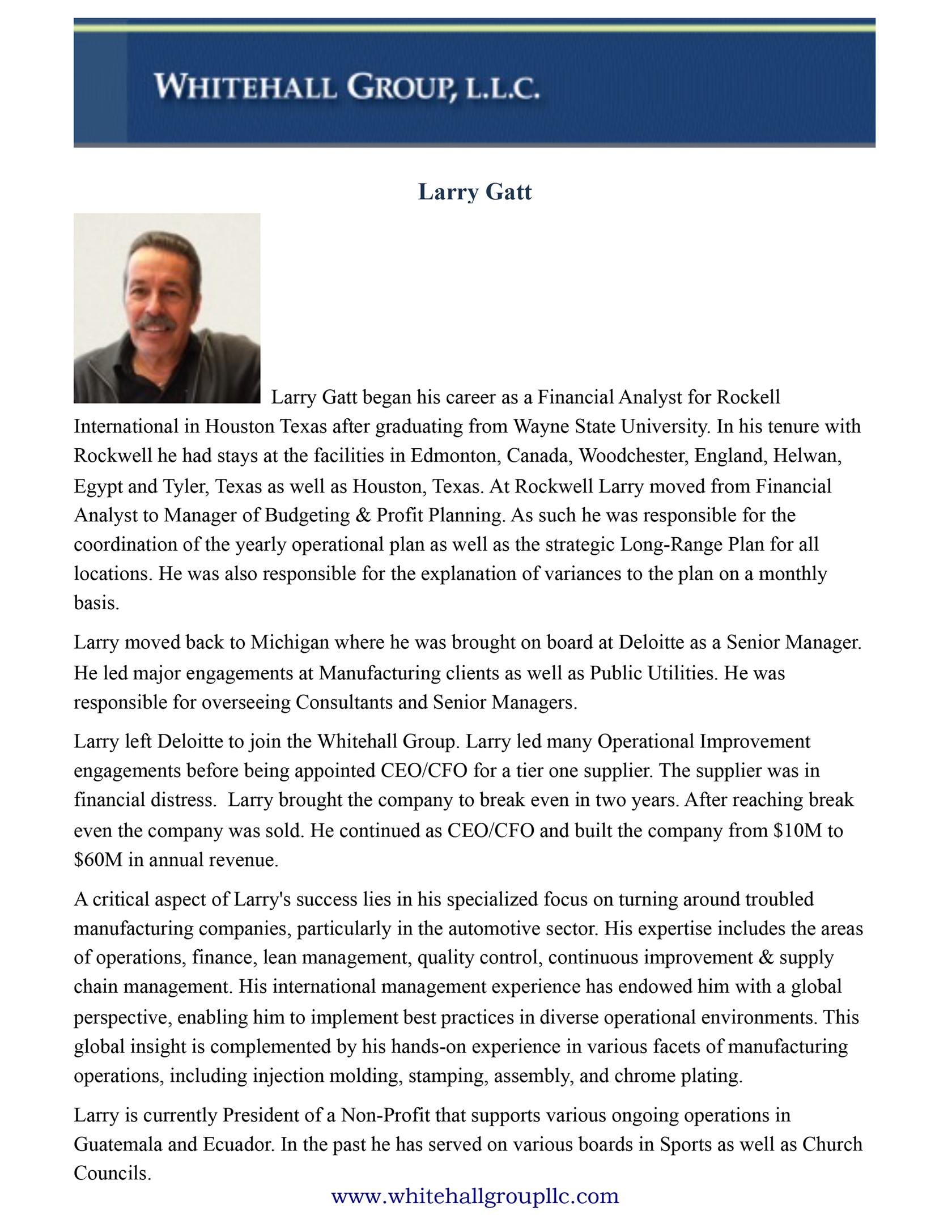

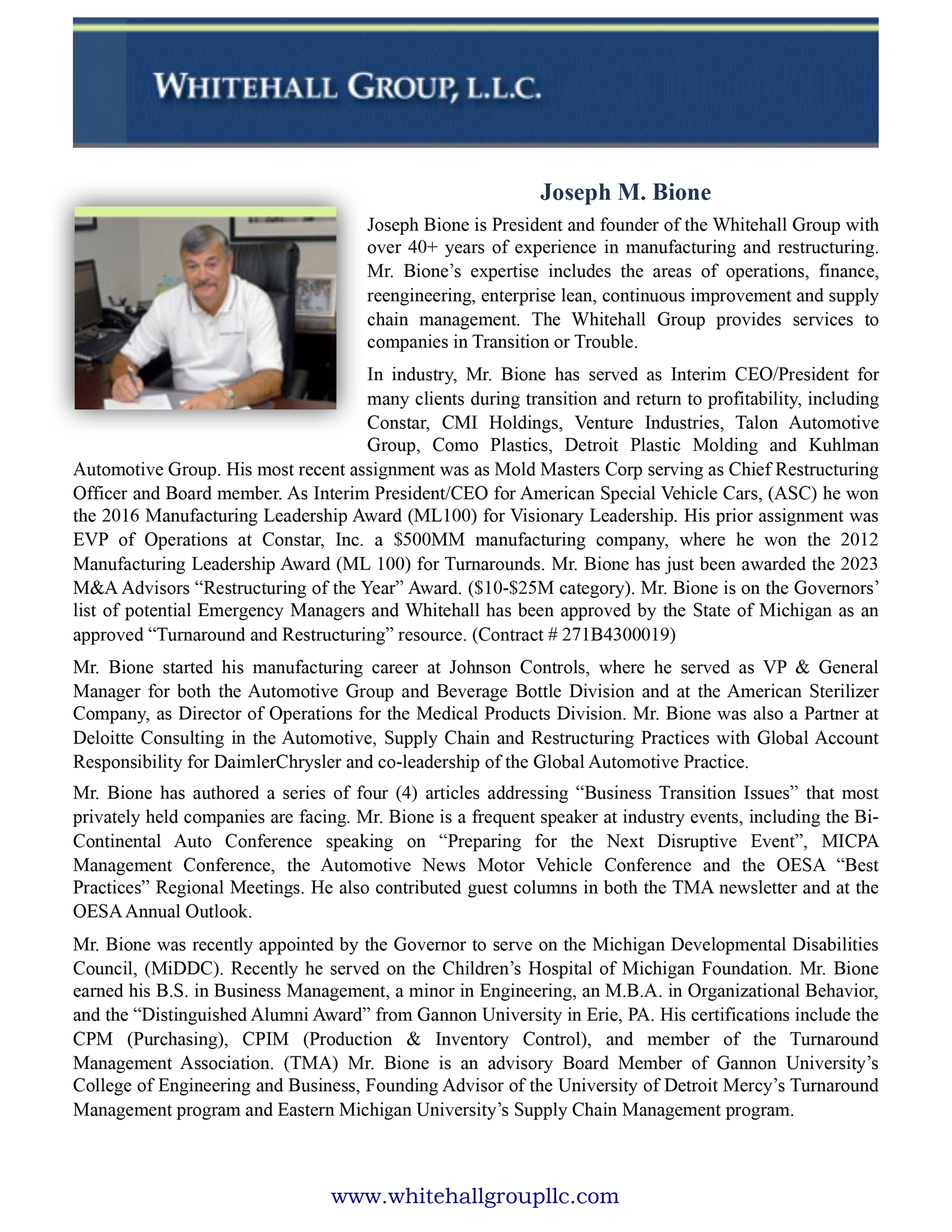

Merger, Acquisition & Divestiture Services

Whitehall customizes solutions to meet your needs.

Whitehall can provide an entire spectrum of services to corporate banks, attorneys, private equity firms, and owners with regard to mergers, acquisitions or divestitures.

Whitehall will tailor a solution to support your particular project objectives. Our buyer and seller advisory services reduce the risks inherent in any acquisition or divestiture deal by providing expert analysis, planning, and coordination and due diligence.

As an independent and unbiased advisor, we give you an informed opinion of the strategic fit and value creation of the prospective acquisition or divestiture. In addition, for those distressed situations where rehabilitation is not an option, we are engaged to help you go through an orderly liquidation of your business. We will assist you to:

- Develop an acquisition or selling strategy that complements your overall business plan

- Identify, contact, and present to acquisition targets or prospective buyers

- Lead and coordinate due diligence, as well as determine valuation and transaction structure

- Assist in negotiating and closing the transaction

- Develop internal and external communication plans

- Plan and structure the integration of the acquisition

- Identify organizational changes and new management roles

- Assist in negotiating and closing the transaction

Merger, Acquisition & Divestiture Services Case Study #1

Waste Management Company: Operational Analysis for an Acquisition

The Facts

- Company had been growing in both the residential and commercial waste management business over the last five years.

- Company was acquiring smaller commercial waste management companies operating within the same geographical region. Financial due diligence was completed, as well as required validation. An operational analysis was required to estimate further contributions to EBITDA and operational synergies.

- Merger integration to save costs and improve efficiency was a major concern/opportunity outside of the current regional boundaries, requiring analysis regarding integration with current local operations.

The Approach

- Understand the scope of the acquisition in terms of purpose, opportunity, and business objectives.

- Review existing reports, documentation, and data associated with the acquisition.

- Identify current and historical operational performance data at both companies.

- Dialogue with management and key operational management/development of key performance indicators (KPIs).

- Visit the acquired company’s operations and obtain additional information.

- Determine primary areas of operational opportunity.

- Using all data and information obtained, identify specific opportunities and savings.

- Report all savings in terms of EBITDA contribution.

The Results

- Operational savings were identified in several key areas, including:

- Headcount reduction

- Driver efficiency

- Maintenance/parts/outside repair reduction

- Administration reduction

- New business

- Price increase potential

- Cost savings opportunities

- Rate reductions

- Consolidation of functions

- An additional $2.6M in operational savings were identified and quantified.

- An EBITDA impact was determined, which defined several approaches for addressing the non-regional business going forward in terms of consolidation and brokering.

Merger, Acquisition & Divestiture Services Case Study #2

40-Year-Old Institutional Food Manufacturing Company

The Facts

- Privately held $100 million food manufacturing company looking to grow through acquiring other companies which they hoped would lead to eventually being acquired.

- Profitable company with $0 debt, protecting owners’ equity is a priority.

The Approach

- Spent considerable time looking into potential companies to acquire.

- Educated ownership on acquisition and merger processes.

- Introduced company to private equity group to understand process value, and options.

- Assist company in pursuing an acquisition of another company by private equity.

The Results

- Assisted in negotiating the value for the business.

- Helped develop the terms and conditions for the sale.

- Provided due diligence support and analysis.

- Completed the sale/purchase of company.

- Ensured ongoing success through a positive transition.