Private Equity Support

The Whitehall Group has been assisting private equity groups, investment banks, attorneys, CPAs, and banks for nearly 30 years in providing a comprehensive set of services, including:

- Operational and financial due diligence

- Operational and financial improvement

- Organizational transformation

- Interim corporate management

Whitehall will tailor a solution to support your particular project objectives. Our buyer and seller advisory services reduce the risks inherent in any acquisition or divestiture deal by providing expert analysis, planning, and coordination and due diligence.

As an independent and unbiased advisor, we give you an informed opinion of the strategic fit and value creation of the prospective acquisition or divestiture. In addition, we can provide interim corporate management services when needed.

Whitehall’s Private Equity Support Services

Operational Due Diligence

Operational/Financial Improvement

Organizational Transformation

Interim Corporate Management

Whitehall management services are available to client companies as a turnkey management team or as an additional management resource. We assist client companies in building additional value in the corporation, managing unique projects that do not fit normal modes of business, and taking advantage of special opportunities.

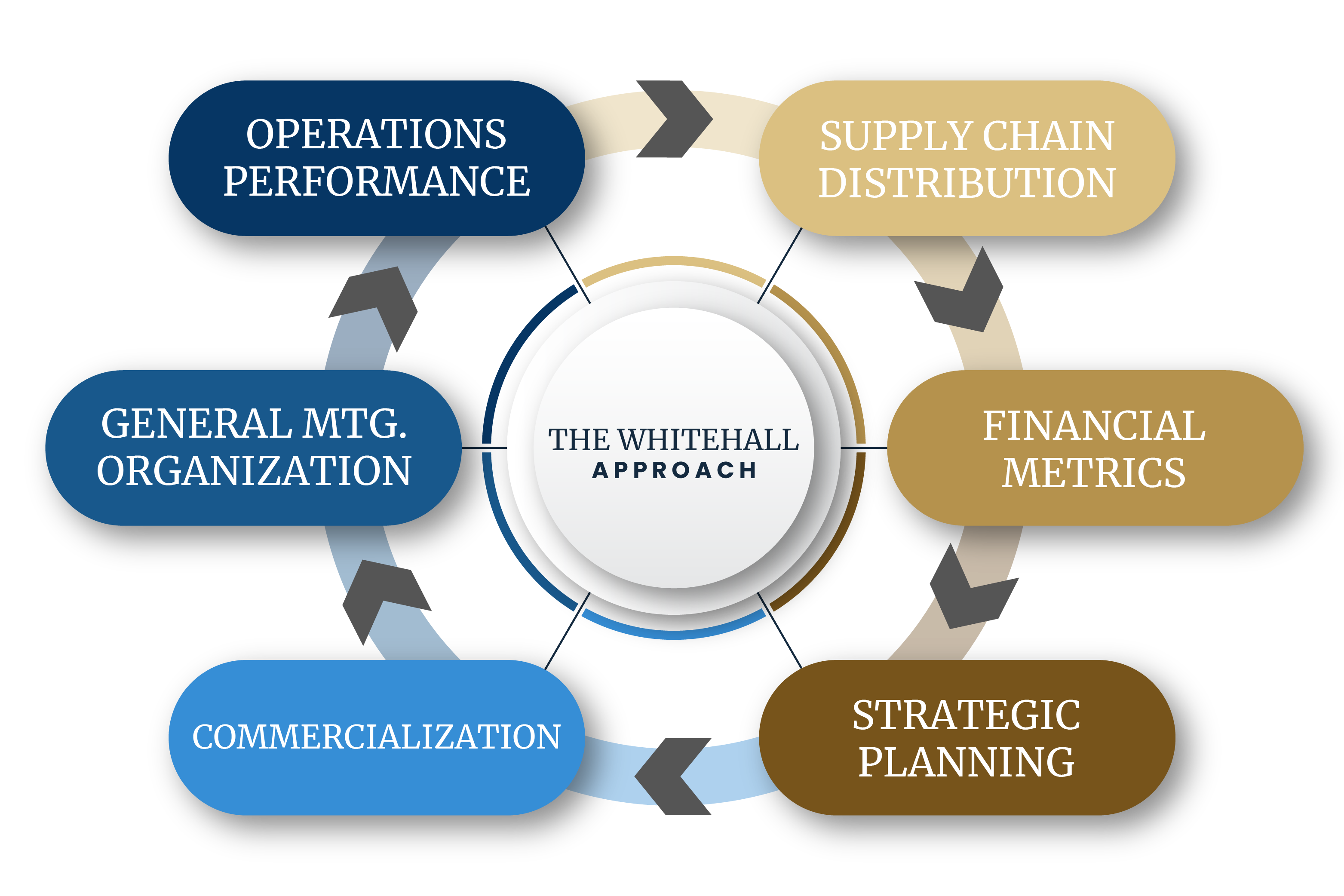

Our Approach

- Supply Chain Distribution

- Financial Metrics

- Strategic Planning

- Commercialization

- General Manufacturing Organization

- Operations Performance

We extend lean principles beyond the shop floor to support functions (“lean office”) up (to customers) and down (to suppliers) value chain.

Everything we do is directed toward rapid improvement in operational performance that drives the financials of the business.

The best way to improve is to evaluate the entire enterprise.